Posts

Transferable Skills in The Financial Services Industry – Why Financial Services Professionals Are in Demand

When you think of professionals from the financial services industry, you might picture individuals working in a highly regulated environment, complying with ever-changing regulations and codes of practice. This industry is characterised by a constant state of flux, with processes, products, systems, literature, language, and responsibilities always evolving. This dynamic environment fosters a unique set of skills and experiences that can be highly valuable in other industries.

However, a study by Barclays LifeSkills revealed that the UK is facing a significant skills gap, with nearly 60% of adults lacking the full set of core employability skills, such as leadership and creativity. This highlights the need for individuals to develop and enhance their transferable skills.

Adaptability and Innovation

One of the key traits developed in the financial services sector is adaptability. The industry is known for its rapid technological changes and innovative new products and services. Professionals in this field must be agile and able to adapt to stay ahead of the curve. This adaptability is not just about surviving in a changing environment, but also about thriving and driving innovation. The financial services sector is home to a blend of established companies and disruptors or startups, creating a diverse range of work environments. This diversity fosters professionals who can thrive in both highly structured and collaborative work settings.

The financial services industry is a hotbed of innovation, with products designed for all age groups, generations, and socio-economic classes. This innovation requires professionals to be quick learners, embrace technology, and adapt to changing customer needs and market trends.

Transferable Skills

Financial services professionals possess a wide range of transferable skills that are highly valued in other industries. These include forecasting, budgeting, variance analysis, presentation and communication skills, the ability to sift through large amounts of data and draw out key insights, influencing skills, analytical skills, accounting/finance skills, leadership skills, and the ability to work under minimal supervision. These skills are not only applicable in other industries but are often critical for success.

In the UK, the value of transferable skills is increasingly being recognised. A survey of UK employers conducted by Nesta and the City of London Corporation found that employers highly value transferable skills. The financial and insurance activities sector was among the industries surveyed, indicating the relevance of these skills in the financial services industry.

A report by Deloitte highlighted the importance of transferable skills in preparing UK workers for a future where jobs will change more rapidly than they have in the past. The report suggested that strategic and analytical skills, among others, are core transferable skills that will determine an individual’s success in the future labour market.

Regulatory Compliance and Risk Management

Working in a highly regulated industry, financial services professionals develop a strong understanding of regulatory compliance. They are accustomed to creating and maintaining financial statements and ensuring compliance with current regulations. This experience can be invaluable in other industries that also face regulatory challenges.

Moreover, the financial services sector is the primary driver of a nation’s economy, providing the free flow of capital and liquidity in the marketplace. Professionals in this industry are better able to manage risk, a skill that is highly transferable and valuable in any industry.

Retaining Your Talent

The past couple of years, marked by the pandemic and the classification of many financial services workers as key workers, have been challenging. The phenomenon known as the “Great Resignation” may indicate an element of employee burnout or fatigue. This is particularly relevant in the financial services sector, which is renowned for its demanding hours and challenging lifestyle.

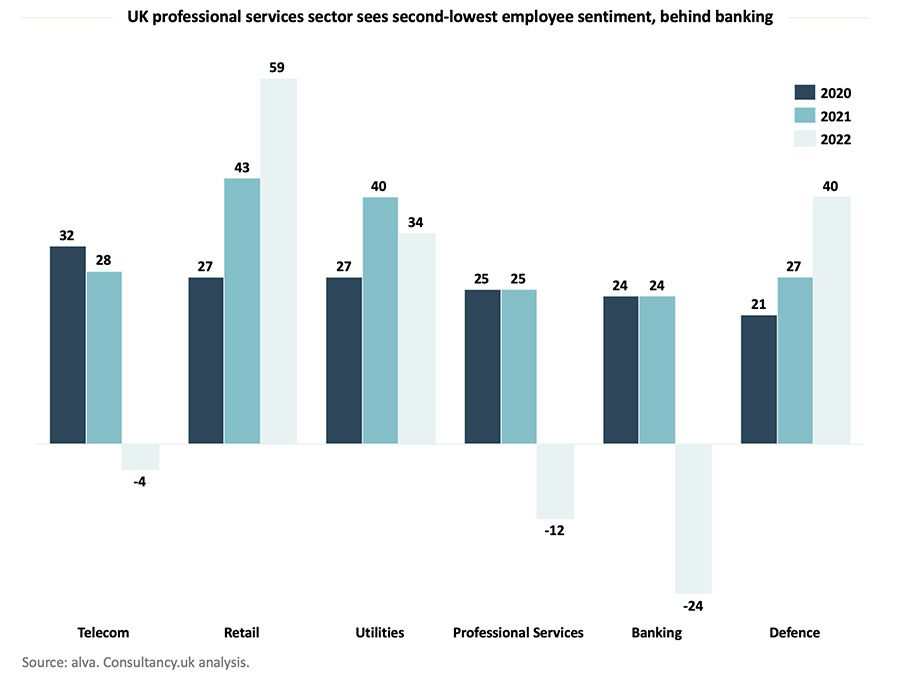

An alva report, highlighted in an article by Consultancy.uk, delves into the evolving landscape of employee sentiment within the UK’s professional service sector from 2020 to 2022.

The report also highlights a noteworthy trend, indicating that employees in the financial and professional services sectors are contemplating career changes. As of the time of this article, seven in ten workers express confidence in their ability to transition to a new job.

In the aftermath of the pandemic, the Banking sector has witnessed a significant decline in employee sentiment, raising concerns about the retention of valuable talent in the post-pandemic landscape. This is why retaining top talent is absolutely crucial. Imagine your team as the backbone of the company, providing the expertise and stability needed to navigate the complexities of the financial world. When your best people stick around, they bring with them a wealth of knowledge and experience that is invaluable. It’s not just about getting the job done; it’s about having a team that can anticipate challenges, adapt to market changes, and capitalize on opportunities, giving your organisation a competitive edge.

Have a read of our article ‘Warning Signs: Could you be losing your top talent?’ to give you some amazing tips on how you can retain your current workforce!

Professionals from the financial services industry bring a unique set of skills and experiences that can be highly valuable. Their adaptability, innovation, transferable skills, and experience in regulatory compliance and risk management make them strong candidates for roles in a variety of sectors. Employers in any industry should therefore see the value in financial services candidates and consider them for roles in their organisations.

If you do need support in your recruitment process, our talented team are here to help.